888-736-7638

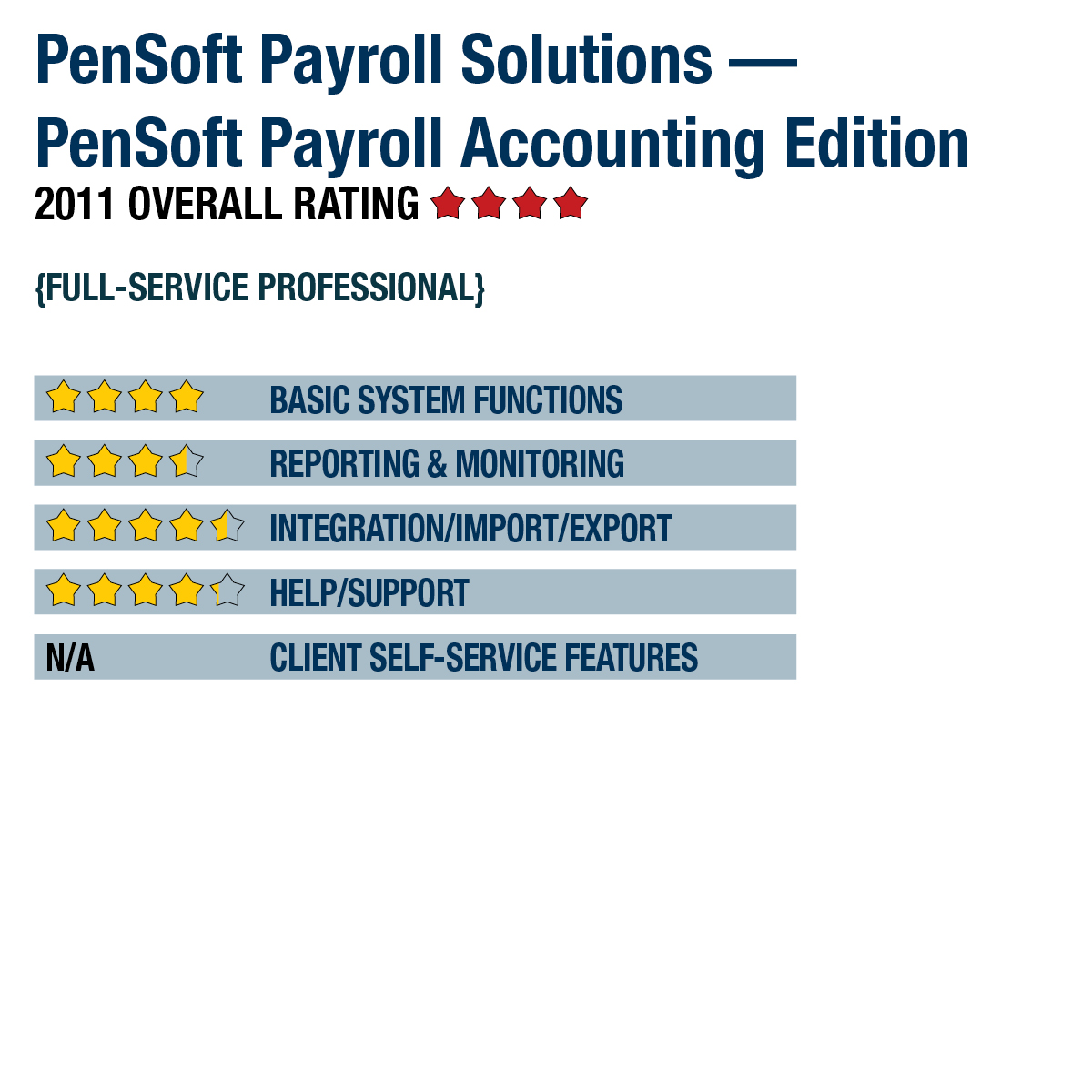

2011 Overall Rating 4

Best Fit

Accounting professionals who provide payroll processing for multiple clients and prefer an on-premises application.

Strengths

- Drag-and-drop report modification allows custom reporting, and report customizations can be saved for use in future months.

- An unlimited number of users can access each company file simultaneously.

- Export files are available for QuickBooks and Sage Peachtree, or data can be imported or exported using Microsoft Excel.

- Supports complex requirements such as job costing, multiple shift differentials, Certified Payroll, and consolidated reporting.

- No additional charge for processing multiple payroll in multiple states.

Potential Limitations

- Does not include a due date tracking feature.

- Employee portals and state electronic payments not supported.

SUMMARY & PRICING

PenSoft Payroll Accounting Edition is an easy-to-use and -navigate payroll solution. With no additional charges to process multiple states or to have access to unlimited support, PenSoft Payroll Accounting Edition may prove to be a cost-effective payroll solution for accounting professionals. PenSoft prices each edition as a calendar year subscription and is based on the number of employees in the largest company currently processed through the system. Initial pricing for PenSoft Payroll Accounting Edition starts at $1,629 for processing unlimited clients each with less than 50 employees. Annual renewal pricing is slightly discounted for future years.

Product Delivery Methods

_X_ On-Premises

___ SaaS

___ Hosted by Vendor

Basic System Functions 4

Reporting & Monitoring 3.5

Integration/Import/Export 4.5

Help/Support 4.25

Client Self-Service Features N/A

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs